Enjoy the Holidays Without Stress: A Mom’s Guide to Family Budgeting and Quality Time

- lasaventurasdearac

- Nov 21, 2025

- 2 min read

The winter holidays—Halloween, Thanksgiving, Christmas, and New Year’s—are full of lights, traditions, and family gatherings. But they can also bring stress, unexpected expenses, and the feeling that there’s “never enough time or money.” As a mom, I’ve learned that the key to enjoying these celebrations isn’t how much we spend, but how we plan, prioritize, and savor every moment together.

Here’s my guide on why, how, when, and what families can do to manage holiday budgets and enjoy more quality time together.

Why Planning a Holiday Budget Matters

Avoid unnecessary debt and long-term stress.

Keep the focus on family, memories, and togetherness, not just gifts or shopping.

Teach children and teens responsible money habits.

When a family feels financially secure, everyone can relax and enjoy the season.

How to Plan Your Holiday Budget

Set an overall budget for each holidayDecide how much you can spend on food, gifts, decorations, and special activities before making purchases.

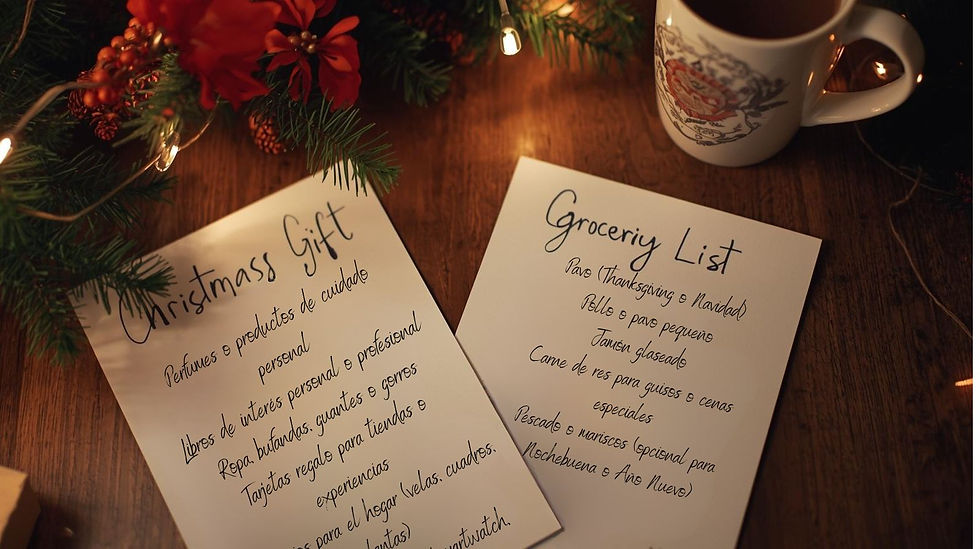

Prioritize what matters mostMake a list of what brings the most joy:

Halloween: costumes and favorite treats

Thanksgiving: a meaningful dinner and family time

Christmas: quality time together and thoughtful gifts

New Year’s: a tradition everyone enjoys

Shop intentionally and earlyAvoid last-minute purchases, which are often more

expensive. Look for sales, compare prices, and consider DIY gifts or experiences instead of physical items.

Include the whole familyTalk about the budget and involve kids in planning decorations, cooking, or choosing gifts. This teaches responsibility and builds family unity.

Get creative with decorations and gifts

Homemade crafts using recycled materials

Gift exchanges with cousins or friends

Baking together, movie nights, or outdoor activities

When to Start Planning

Christmas and New Year’s: Begin in October or November.

Halloween and Thanksgiving: A few weeks in advance is usually enough.

Weekly check-ins: Monitor your budget to stay on track.

What Decisions to Make to Reduce Stress

Gifts: Set spending limits and focus on meaningful items, not quantity.

Food: Plan simple but special menus; cooking together can be fun and budget-friendly.

Decorations: Focus on what brings real joy; DIY is often creative and cost-effective.

Activities: Prioritize experiences that strengthen family bonds rather than expensive outings.

Tips to Enjoy the Holidays More

Simplify expectations: It’s about being together, not perfection.

Create meaningful traditions: Family stories, crafts, games, and songs create lasting memories.

Take care of yourself: Even a short break for parents improves patience and energy.

Remember the true purpose: Celebrate, be grateful, and share time with loved ones.

Practical Example

If your Christmas budget is $300:

Food: $120

Gifts: $120

Decorations: $40

Extras (crafts, small surprises): $20

Planning in advance keeps spending under control while ensuring everyone enjoys the season.

Conclusion

Holidays can be joyful or stressful—the difference is intentional planning and decision-making. By setting a budget, prioritizing what matters, involving the family, and focusing on meaningful moments, you can create lasting memories and teach important life skills.

Remember: the most valuable things in life aren’t bought—they’re shared. With organization, creativity, and love, the holidays can become the happiest time of the year for your family.

.jpg)

Comments